A Look at Supplier Flexibility, Prices and Storage

August 11th, 2018 12:05 am | by John MacCormack Ph.D. P.Eng. | Posted in Uncategorized

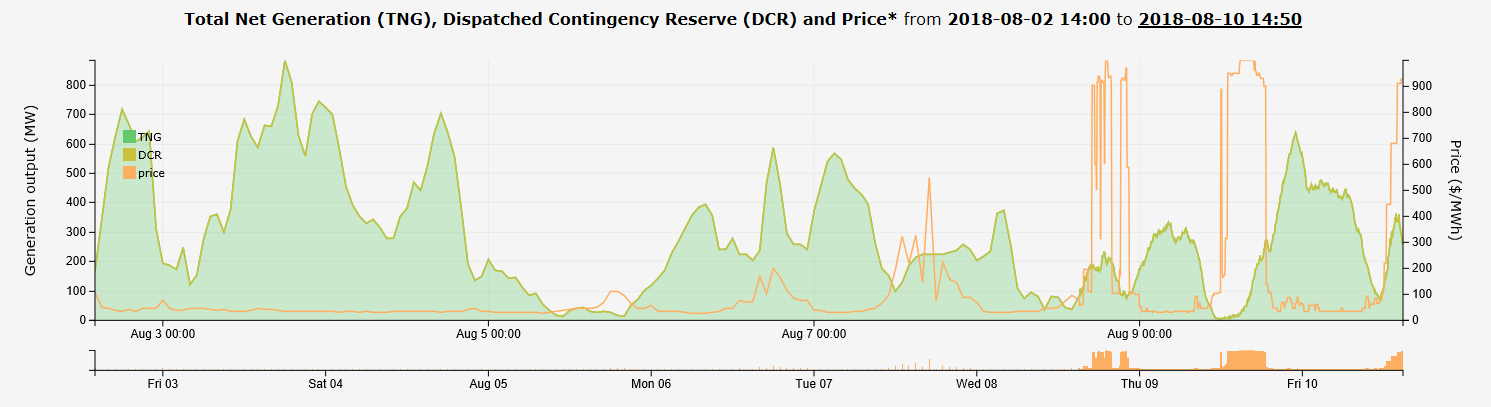

Looking at the PSTI’s website at https://psti.ca/agt-dashboard shows a wide variation in the average prices various suppliers receive for the energy they deliver. Of all the asset classes wind generation has continued to receive the lowest prices for the energy it delivers. ($79.1/MWh in the last week) Looking at the pattern of wind generation reveals the reason. In general when wind generation is high, prices are low.

Fig. 1 Wind generation and prices over the last week

Given the scale of wind generation in Alberta (1445 MW installed) it seems that, at least in part, the wind generation is the cause of its own prices. Since much more wind generation is anticipated[1] in the future, the discount from average electricity prices that wind generators receive can be expected to increase.

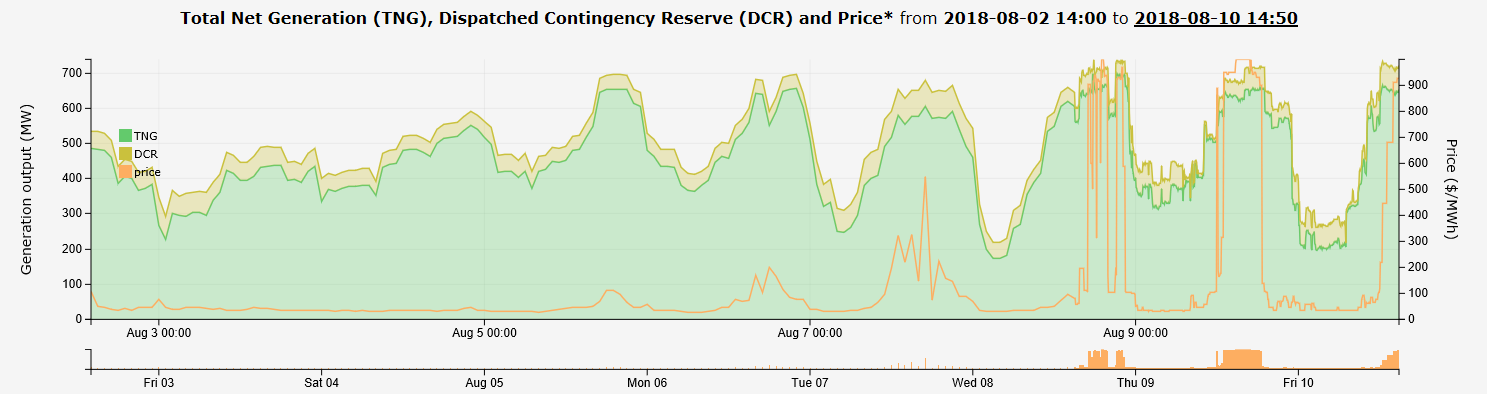

Generators with the flexibility to vary their output in response to prices are receiving a premium to average electricity prices as can be seen by looking at the prices received by simple cycle generators. ($144.8/MWh on average over the last week)

Fig. 1 Simple cycle generation and prices over the last week

The difference in realized prices between different suppliers highlights the importance of timing and the value that storage could bring.

Without congestion, the value of storage is greatest when it responds to system conditions as a whole– buying energy at the lowest prices and reselling it during the highest price periods.

Of course if more storage is introduced, short term price differences over time will be reduced. However, storage is not free, – in addition to the fixed costs of storage facilities, there is the cost of energy stored and the losses incurred in the storage and discharge cycle. Thus storage should not be expected to bring all price differences to zero – rather, in the long term storage storage should only reduce price differentials where it is economical to do so.

Short term price differentials in the market are going to vary over time as the quantity and cost of supplies relative to demand varies. Looking at the short term price differentials that are needed to support the fixed and variable costs of storage is important but this doesn’t provide much guidance on how those differentials can vary in the market over the years.

To see how price differentials might vary over the longer term some guidance may be given by looking at the interchange with the neighbouring province of British Columbia.The hydro reservoirs in our neighbouring province provide large storage opportunities and the tieline to British Columbia provides a large capacity conduit to realize the value of that storage.

The PSTI website shows the average price received by imports (from BC, Saskatchewan and Montana) over the last week has been $236.1/MWh. ($287.7/MWh for the intertie with BC alone).

The average price paid for energy exported to British Columbia over the last week of $106.2/MWh is not shown but the PSTI website allows users to easily perform simple analysis such as this by downloading the data underlying the graphs shown. (using the Download data as CSV command shown on the website)

A longer history of electricity prices and import and export volumes can give some indication of the longer term variability of price differentials over time.

Fortunately, long term histories of electricity prices and import and export volumes are readily available from the AESO’s website.[2]

The anticipated large scale integration of wind generation may act to increase both the need for and the value of storage in the future.

[1] https://www.aeso.ca/download/listedfiles/AESO-2017-Long-term-Outlook.pdf https://www.aeso.ca/download/listedfiles/2017-LTO-data-file.xlsx,

[2] AESO website http://ets.aeso.ca/ metered volumes (all) report.

Hey John

Just discovered your blog…. I have enjoyed reading your posts and appreciate your insightful observations. Keep it going!

Kind Regards,

Bob Howland

Thanks Bob. Much appreciated.